Module for applying the relevant equivalence surcharges

Module that automatically adds the equivalence surcharge to the order, according to the type of customer and VAT applied to the products.

Why do I need this module?

Not all customers are alike. With this module you can create special customer groups and apply discounts or equivalent surcharges according to your company and e-mail address.

All functionalities of the module:

Customer groups: discounts and surcharges.

This module allows users to be automatically assigned to a particular customer group based on:

- Name of the company to be indicated when registering.

- Email to be provided upon discharge.

In this way users can benefit from discounts or surcharges by belonging to a special group of customers.

Easy for your customers

Customers can choose, at the time of registration, whether they want a surcharge or not and this information will be recorded without having to register and then select the option they need.

In addition, if you need to change your settings, you can activate or deactivate the equivalence surcharge from the My Account > Options tab whenever you want.

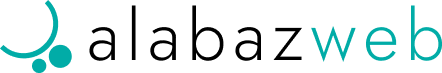

Equivalence taxes.

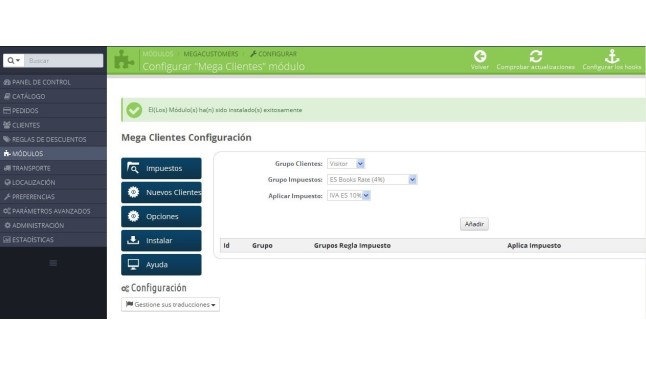

The second functionality of the module allows you to set different equivalence surcharges depending on the customer group and the VAT of the selected product.

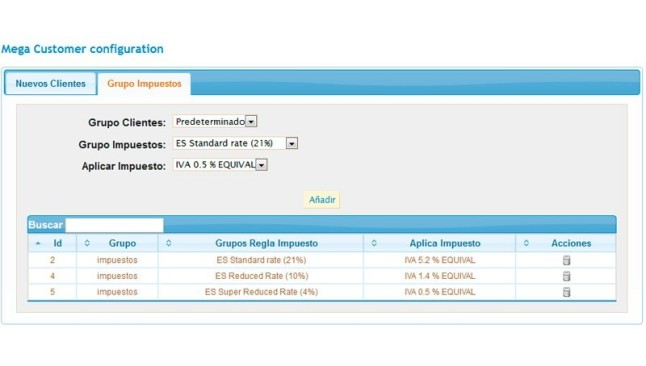

In accordance with Royal Decree Law 20/2012, the following types of surcharge apply:

- For general articles of 21%: surcharge of 5,2%

- For articles with a reduced rate of 10%: surcharge of 1,4%

- For items with a super-reduced rate of 4%: 0,5% surcharge

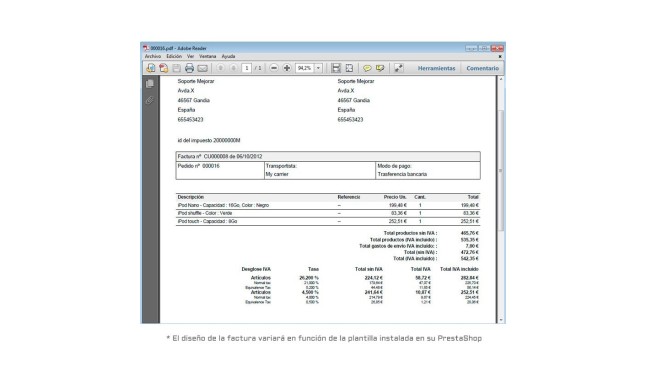

All the information

The invoice includes total tax, VAT and surcharge. All the information broken down and clear to your client.

Notes:

*Invoice design will vary depending on the template installed in your PrestaShop.